Today, Urgewald and 34 NGO partners published the 2024 update of the Global Oil & Gas Exit List (GOGEL). GOGEL is the most comprehensive public database of companies in the oil and gas industry. It covers 1,769 companies active in the upstream, midstream and power sectors. Companies on GOGEL are responsible for 95% of global oil and gas production.

GOGEL 2024 can be downloaded at gogel.org

In 2023, oil and gas production reached a historic high. In the hottest year on record, companies on GOGEL produced 55.5 billion barrels of oil equivalent (bboe). Global hydrocarbons production surpassed the pre-COVID all-time high. “This production record is deeply concerning. If we do not end fossil fuel expansion and move towards a managed decline of oil and gas production, the 1.5 °C goal will be out of reach,” says Nils Bartsch, Head of Oil & Gas Research at Urgewald. One year ago, the UN Climate Change Executive Secretary heralded the COP28 agreement as the ‘beginning of the end’ of the fossil fuel era. But oil and gas companies’ actions tell a different tale: One where oil and gas expansion becomes a never-ending story.

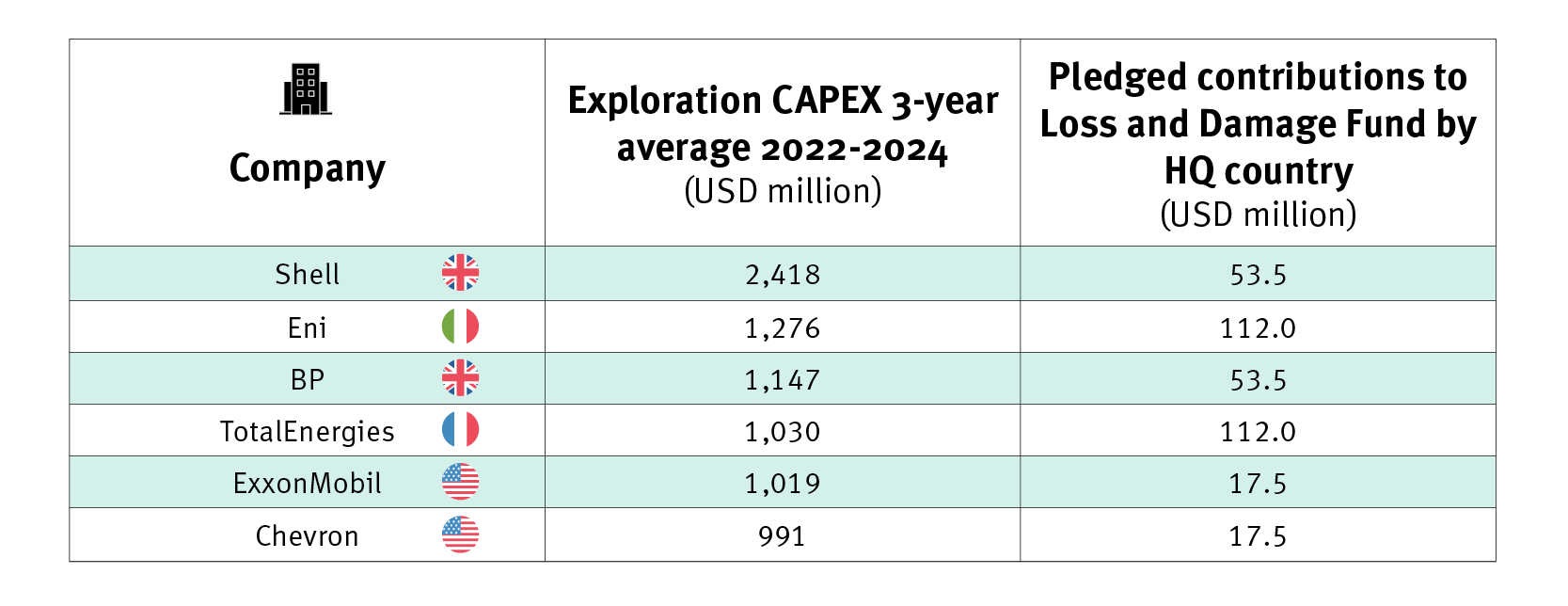

Exploration Spending Means More Loss and Damage

At COP29, all eyes are on the loss and damage negotiations. “Africans are already paying a terrible price for climate change, although our continent accounts for the smallest share of global greenhouse gas emissions,” says Bobby Peek, Executive Director of the South African NGO groundWork, Friends of the Earth, South Africa. “Lives and homes lie in ruins after catastrophes like this year’s devastating floods in Niger, Mali and Nigeria, and millions are facing acute hunger due to prolonged drought in the Horn of Africa. Paying for climate-induced loss and damage is a matter of justice and accountability, not charity.”

At last year’s climate conference, world leaders made total pledges of $702 million to the Loss and Damage Fund, falling far short of expectations. Meanwhile, the oil and gas industry is pouring nearly 90 times this amount into searching for new reserves each year. GOGEL shows that, together, upstream companies are spending an average of $61.1 billion on exploration annually.

Table 1: Exploration spending by majors vs. loss and damage pledges by HQ country[1]

“It is perverse to see companies shelling out tens of billions of dollars each year to search for new oil and gas reserves that will lead to even more loss and damage in the future. The paltry sums governments have pledged to the Loss and Damage Fund are only a small fraction of what Big Oil spends to make things worse. World leaders need to make polluters pay and direct this money towards a just transition for all,” says Tinaye Mabara from the Agape Earth Coalition.

Short-Term Expansion Could Push Planet beyond 2 °C

Exploration today results in new oil and gas fields tomorrow. Companies are already developing oil and gas fields that could even push global warming beyond 2 °C.[2] 578 upstream companies on GOGEL intend to tap into 239.3 bboe of new resources in the next 1 to 7 years. Some of the fields currently being developed, like ConocoPhillips’ 600-million-barrel Willow project in Alaska, could continue production beyond 2100.[3] The seven companies with the largest short-term expansion plans are Saudi Aramco (19.6 bboe), QatarEnergy (17.8 bboe), ADNOC (9.5 bboe), ExxonMobil and Gazprom (9.4 bboe each), and TotalEnergies and Petrobras (8.0 bboe each).

Almost two-thirds of the industry’s short-term expansion plans overshoot the International Energy Agency’s (IEA) scenario for net zero emissions by 2050.[4] State-owned Saudi Aramco has the highest 1.5 °C overshoot with 11.6 bboe, followed by ADNOC (8.4 bboe), QatarEnergy (7.8 bboe), ExxonMobil (6.6 bboe), NIOC (5.2 bboe), Petrobras(4.7 bboe), TotalEnergies (4.5 bboe) and Shell (4.4 bboe). How unconcerned these companies are about overshooting the IEA’s 1.5 °C scenario was openly voiced by Saudi Aramco’s CEO Amin Nasser. At an energy conference in Houston last March, he said: “We should abandon the fantasy of phasing out oil and gas.”[5]

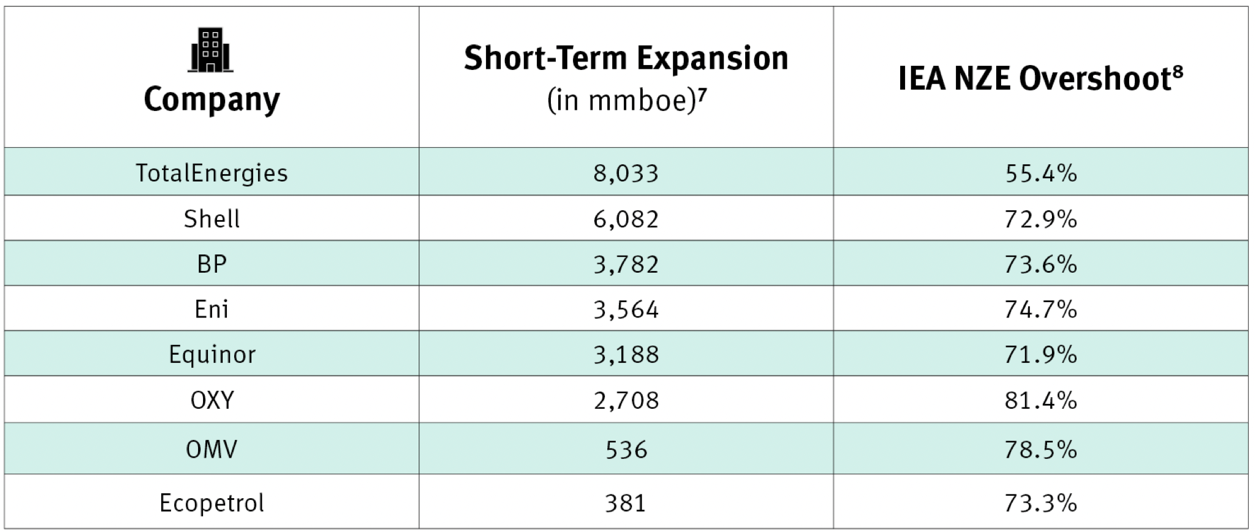

Worthless Net-Zero Pledges

The oil and gas industry is not transitioning. In fact, 95% of the upstream companies on GOGEL are still exploring or developing new oil and gas resources. This includes the oil and gas producers TotalEnergies, Shell, BP, Eni, Equinor,OXY, OMV and Ecopetrol, which all claim to be targeting net zero emissions by 2050.[6] According to GOGEL, the short-term expansion plans of each of these companies show an overshoot of over 50% when compared to the IEA’s Net Zero by 2050 scenario. As if this wasn’t enough, these companies are collectively spending nearly $8.4 billion annually on exploration of new oil and gas fields.

Table 2: Short-term expansion plans of oil and gas producers with net zero commitments for all 3 emission scopes[7][8]

“These companies’ climate targets hinge on completely unrealistic Carbon Capture and Storage (CCS) aims, building renewables to power their oil and gas production and adding more gas to their portfolio. None of them have sufficient targets for a year-by-year decline of production, let alone production phase-out goals. All the renewable build-out in the world will not limit global warming to 1.5 °C without a fossil fuel phase-out,” says Regine Richter, Finance Campaigner at Urgewald.

LNG and Gas-Fired Power Boom in South and Southeast Asia

GOGEL also provides detailed data on companies planning new LNG, pipeline and power projects. This type of infrastructure typically has a lifespan of several decades and locks energy systems into fossil fuel dependency, spurring more upstream activity. The disaggregated figures on LNG terminal expansion show that the industry plans to increase global LNG import capacity by 57% to 1,746.9 Mtpa. “Gas producers are derailing climate efforts by pitching their fossil gas as an alternative to coal. However, new research shows that LNG can have a 33% worse greenhouse gas footprint than coal”,[9] comments Nils Bartsch.

Many countries are still planning a massive build-out of gas-fired power plants, often relying on imported LNG. Two of the world’s LNG hotspots are South and Southeast Asia, together home to a quarter of global LNG import terminal expansion (156.6 Mtpa) and gas-fired power development (144.9 GW). If built, these projects would more than double regasification capacity in both regions. Gas-fired power capacity would increase by 31% in South Asia and more than double in Southeast Asia. India (56.2 Mtpa), Vietnam (44.6 Mtpa) and Bangladesh (16.2 Mtpa) have the largest LNG import plans.

Power companies plan to increase gas-fired power capacity by nearly 100 GW in the three top countries alone: 45.5 GW in Vietnam, 28.2 GW in the Philippines and 25.7 GW in Bangladesh. In the Philippines, the industry’s gas expansion plans are equivalent to the country’s entire operating power fleet.[10] The top gas power developers in South and Southeast Asia are Bangladesh Power Development Board (16.8 GW), PetroVietnam (7.4 GW), San Miguel Corporation (7.1 GW), Electricity Generating Authority of Thailand (5.9 GW) and Manila Electric Company (3.9 GW).

“Global power production needs to reach net zero emissions within the next two decades. Gas-fired power plants typically have a lifespan of 25–40 years. Many are being built by the same companies that led us into coal dependency. If we allow them to go on, we will be discussing how to finance the early retirement of their gas plants at COP40, just like we are discussing the early retirement of their coal plants today,” says Nils Bartsch.

Resisting Gas

For over a decade, the Bangladesh Power Development Board has been compiling an oversized portfolio of gas-fired power projects. It is currently the top gas power developer on GOGEL. However, many of these projects are now up in the air. The country’s interim government is reviewing multiple gas power project approvals and has already cancelled Summit Group’s major second LNG project. The developers of LNG terminals, pipelines and power plants depend on political tailwind. If it turns against them, they have little chance of success. This leaves the projects and their financial backers at risk.

“We applaud the decision of our interim government to review the misguided gas build-out plans in Bangladesh. We will continue to pressure our government to enable a fair and affordable energy transition for all, focusing on our impressive renewable potential instead of false solutions,” says Hasan Mehedi, Chief Executive at Coastal Livelihood and Environmental Action Network (CLEAN).

The political and economic case against a gas-fired future in South and Southeast Asia is evident. Renewables are abundant and competitive. Bangladesh could potentially meet its entire electricity demand with solar power.[11] In Southeast Asia, 328 GW of additional renewable energy capacity is currently planned, 3 times more than companies’ gas-fired power expansion plans.[12] In many countries, civil society is protesting expensive, emission-intensive LNG-to-power projects. Environmental groups from the Philippines are mobilizing globally to end gas expansion in the biodiversity paradise of the Verde Island Passage (VIP)[13].

"Fossil gas expansion in the VIP threatens one of the world’s most biodiverse marine habitats and source of food and livelihood for millions of Filipinos. There is no space for this destructive and expensive fossil fuel when the Philippines has a renewable energy potential enough for an urgent and 100% transition,” says Gerry Arances, Executive Director of the Center for Energy, Ecology, and Development. “Communities and civic movements already pushed our government to ban new coal projects in the past; those behind the gas buildout in the VIP, the rest of the country, and the similarly threatened Coral Triangle should expect the same rejection.”

The global fossil gas boom is still preventable. Especially in South and Southeast Asia, where only 16% of planned LNG import capacity and 18% of gas-fired power expansion capacity are currently under construction. Most of the remaining projects still need financial commitments to move forward. We are at a climate crossroads, where financial institutions have the power to push the world into decades more of fossil fuel dependency or turn towards a truly sustainable future.

The Finance Industry Needs Effective Oil & Gas Exclusion Policies

Since the Paris Agreement was signed, the world’s 60 largest banks have poured $3.3 trillion into fossil fuel developers.[14] And in 2024, institutional investors such as pension funds, insurers and asset managers hold investments of over $4.5 trillion in the oil and gas industry.[15]

Despite these dismal figures, parts of the finance industry are beginning to realize that an expanding oil and gas industry is incompatible with a stable climate future. 39 large financial institutions have adopted meaningful oil and gas policies that exclude investing in a significant portion of the industry. Two of the world’s largest banks, BNP Paribas and Crédit Agricole announced in May of this year that they will no longer participate in conventional bond issuances by companies in the oil and gas industry.[16] And in October, the insurer Generali dealt a blow to LNG, pipeline and gas power developers. Italy’s largest insurance company declared it will no longer provide new cover for companies in the midstream and downstream sector identified as “transition laggards”.[17]

“Phasing out fossil fuels requires a phase-out of fossil fuel financing and insurance. The oil and gas industry will not transition until financing dries up. The recent announcements by Generali, BNP Paribas and Crédit Agricole are a good sign, but they are only a tiny step in the right direction. More financial actors and insurers need to step up and pass strict policies that prevent a disastrous fossil fuel lock-in. Otherwise, the 1.5 °C goal will be irretrievably lost,” says Regine Richter.

About GOGEL

GOGEL is the most comprehensive public database on the oil and gas industry. It was created to speed up the adoption of meaningful oil and gas policies by the financial sector. The 2024 GOGEL provides detailed information on 1,769 companies. It is a forward-looking database and offers a wide range of metrics that allow its users to assess companies’ oil and gas expansion plans in the upstream, midstream and power sectors.

GOGEL also allows users to identify companies that are not in line with the IEA Net Zero Emissions Scenario. In addition, GOGEL highlights companies’ involvement in selected reputational risk projects that exacerbate violent conflicts, cause immense social and environmental harm or are challenged by lawsuits and local community opposition.[18]

270 financial institutions are currently using GOGEL to scan their portfolios or to develop new exclusion policies. Many academics, journalists and civil society organizations also use GOGEL to assess, scrutinize and better understand the oil and gas industry. GOGEL is built on information from company data sources such as annual reports and investor presentations, Rystad Energy, and Global Energy Monitor. GOGEL is updated each fall and will be expanded over time to cover further subsectors of the oil and gas industry.

GOGEL 2024 is co-published by Urgewald and ActionAid Denmark, Attac Österreich, Arayara, BankTrack, Both ENDS, Center for Energy, Ecology, and Development (CEED), Centre for Environmental Rights (CER), Coastal Livelihood and Environment Action Network (CLEAN), Climate Action Network (CAN), Friends of the Earth (FoE) France/Les Amis de la Terre, Friends of the Earth (FoE) USA, Global Energy Monitor (GEM), Green Innovation and Development Centre (GreenID), Collapse Total, Klima Allianz, Laudato Si Movement, Oil Change International (OCI), Rainforest Action Network, Reclaim Finance, ReCommon, Shift Action, Solutions for Our Climate, Stand.earth, Ekō, The PRAKARSA, Maan ystävät (Friends of the Earth Finland), Groen Pensioen, The Sunrise Project, Ecodefense, Amazon Watch, Green America, Just Share, 350 Japan.

[1] These 6 companies are commonly referred to as oil and gas majors

[2] Big Oil Reality Check, p. 9:

https://www.oilchange.org/wp-content/uploads/2024/05/big_oil_reality_check_may_21_2024.pdf

[3] Rystad Energy UCube

[4] The IEA’s NZE scenario represents the bare minimum needed to keep 1.5 °C within reach. Based on the original scenario as published in 2021 and updated in 2022, which states that in a 1.5 °C world, approval of new oil and gas fields is not needed after 2021. See IEA (2022), p. 133: https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf

[5] https://www.cnbc.com/2024/03/18/saudi-aramco-ceo-says-energy-transition-is-failing-give-up-fantasy-of-phasing-out-oil.html

[6] Covering all 3 emission scopes according to Climate Action 100+, October 2024: https://www.climateaction100.org/net-zero-company-benchmark/

[7] GOGEL’s short-term expansion metric includes resources categorized by Rystad Energy as “in field evaluation” and “under development.” Companies will start producing these resources in the near future (i.e. in approx. 1–7 years). The exact time frame depends on the type of asset.

[8] Based on the original scenario as published in 2021 and updated in 2022, which states that in a 1.5 °C world, approval of new oil and gas fields is not needed after 2021: See IEA (2022) p. 133: https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf

[9] https://www.research.howarthlab.org/publications/Howarth_LNG_assessment_preprint_archived_2023-1103.pdf

[10] https://doe.gov.ph/sites/default/files/pdf/energy_statistics/01_Summary_of_2023_Power_Statistics.pdf

[11] https://www.evwind.es/2024/07/02/bangladesh-can-meet-entire-electricity-demand-by-photovoltaic-solar-energy/99469

[12] Confronting A Fossil Future p.5: https://ceedphilippines.com/wp-content/uploads/2023/12/Confronting-a-Fossil-Future-2023.pdf

[14] Banking on Climate Chaos 2024, p.57: https://www.bankingonclimatechaos.org/wp-content/uploads/2024/07/BOCC_2024_vF3.pdf

[15] https://investinginclimatechaos.org/media/pages/reports/ed622ba9ca-1721910411/pr.iicc-2024.pdf

[16] https://reclaimfinance.org/site/en/2024/05/31/bnp-paribas-and-credit-agricole-say-no-to-bonds-for-the-oil-and-gas-sector/

[17] https://www.generali.com/sustainability/our-commitment-to-the-environment-and-climate

[18] See https://gogel.org/reputational-risk-projects